With economies opening up, and energy demand recovering, WTI crude oil price is squirming out of its ultra-lows and approaching to pre-Corona levels. Yet, assuming that fading away of Coronavirus will take time and US crude oil stocks continue to accumulate due to rising imports, the oil’s further recovery may not be as smooth as we have witnessed in the past three weeks. Important to note that, rising inventories have had no downward pressure on oil prices simply because expansionary monetary policies degrade the volatility across all asset classes. Going into the new month, investors may want to re-evaluate their portfolios to manage their risks and get out of fundamentally expensive assets that range from stocks to commodities of all types.

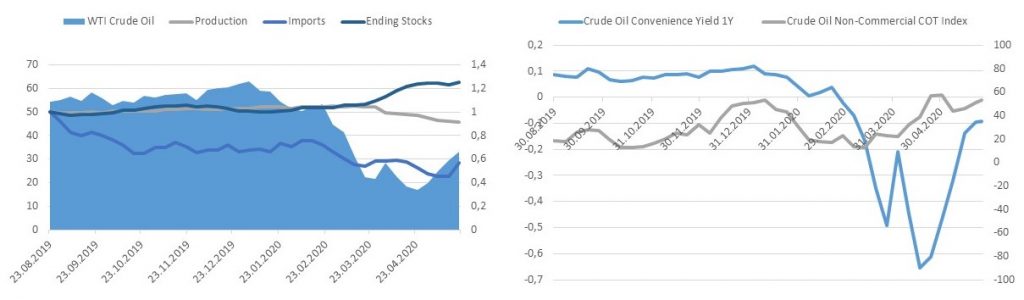

Data show that crude oil is fundamentally and relatively getting expensive. Convenience yield, which can be employed as a timing tool to estimate reversals, is approaching to the positive barrier, which makes no sense with the given level of high inventories and weak demand. The COT index has reached to pre-Corona and pre-OPEC+ crisis level. The crack spread is 30% off since early January suggesting that by-products of crude oil, such as heating oil and gasoline are relatively underpriced and/or crude oil is overpriced at a time when crude oil’s future demand is in question.

By the same token, rising WTI crude oil/SP 500 ratio and the spread of COT indices of the two supports the expectation that perhaps WI crude oil has a bit further room to rise but with the current social and economic conditions, SP500’s support for the crude oil may withdraw and be sold off after further weak gains.