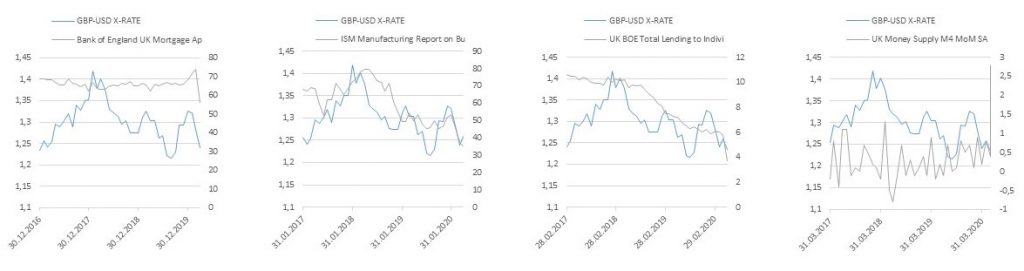

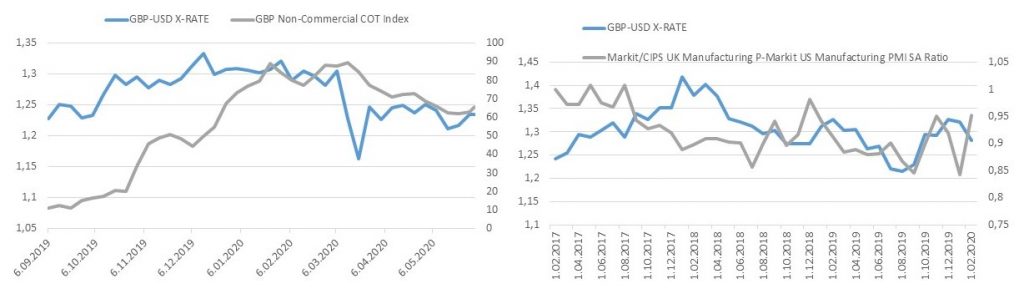

Since the burst of Coronavirus, GBPUSD pair has been under steady selling pressure due to the perception that US Dollar serves as safe harbor for the fearful capital and the closure of UK economy. It looks like however, things may begin to change soon. British Pound is nowadays looking for ways to fend off persistent sales pressure in response to unpleasant US economic data and social unrest in the US. Commitment of Traders Index confirms that investors are no longer reluctant to buy GBP and therefore funds may replace their USD holdings with those of GBP especially with the emergence of better than expected UK data and/or relatively worse US data.

Markit’s Manufacturing PMI data that will be announced from both UK and US may inspire the market to replace a decent amount of USD into GBP. With this respect, following the announcements, if the ratio of UK Manufacturing PMI and US Manufacturing PMI inches higher, traders may look to buy the GBPUSD on dips and then wait for tomorrow’s UK and US data for further action.